The last week of December can stretch any budget. Gifts, travel, utilities, and the first bills of the new year can land all at once. If you are weighing options to cover short term expenses, understanding how cash loans in Utah work can help you make a clear, informed decision. This guide explains the basics, what to expect during the application, and how to borrow responsibly during the holidays.

What are cash loans in Utah?

Cash loans are installment loans that provide a lump sum that you repay over a set schedule. Payments are fixed, which makes budgeting simpler than juggling multiple card balances. Many Utah borrowers use these loans for time sensitive needs like car repairs, medical bills, or to smooth out seasonal spending.

With Money 4 You, the experience is streamlined. There is no hard credit check, approvals can be less than 10 minutes when your documents are ready, funds can be transferred within seconds after approval, and there are no prepayment penalties.

When a cash loan may fit and when it may not

Potential fit

-

You need funds quickly and want predictable payments

-

You prefer a clear payoff date instead of an open ended balance

-

You want the option to pay early and save on interest

Potential misfit

-

You do not have room in your budget for a new payment

-

You only need to bridge a few days and a fee free alternative is available

-

You are considering borrowing more than you reasonably need

The right choice balances speed, cost, and your ability to repay on time.

How lenders evaluate first time borrowers

Even without a hard credit check, lenders look for indicators that a loan is affordable.

-

Income and employment

Steady income supports approval and can help with better terms. -

Debt to income ratio

Lower monthly obligations relative to income leave room for the new payment. -

Requested amount and term

A right sized loan that matches your need can be easier to approve. -

Consistency of information

Application details should match your documents.

What to prepare before you apply

Getting organized can turn a stressful day into a simple one. Gather these items first.

-

Government issued photo ID

-

Proof of income such as recent pay stubs or bank statements

-

Proof of address like a utility bill or lease

-

Employer name and contact information

-

Banking details for fast funding after approval

Having your documents ready often shortens the time from application to funding.

Costs, terms, and how to compare offers

Comparing cash loans in Utah comes down to a few levers that affect total cost.

-

APR

The annual percentage rate reflects borrowing cost. Ask for the payment schedule and the total of payments to understand the full picture. -

Term length

Shorter terms generally mean higher monthly payments and lower total interest. Longer terms reduce the payment and increase overall interest. -

Fees

Review any origination or late fees. With Money 4 You, there are no prepayment penalties, which means extra payments can reduce interest and shorten the term.

A quick rule of thumb is to choose the shortest term that still fits your monthly budget.

Step by step application with Money 4 You

-

Start the application

Share basic personal, employment, and income details. There is no hard credit check. -

Upload documents

Provide your ID, proof of income, and proof of address. -

Decision

Approval can be less than 10 minutes when information is complete. -

Review terms

Confirm loan amount, payment, due date, and any fees. -

Sign

E sign your agreement securely. -

Receive funds

Funds can be transferred within seconds after approval.

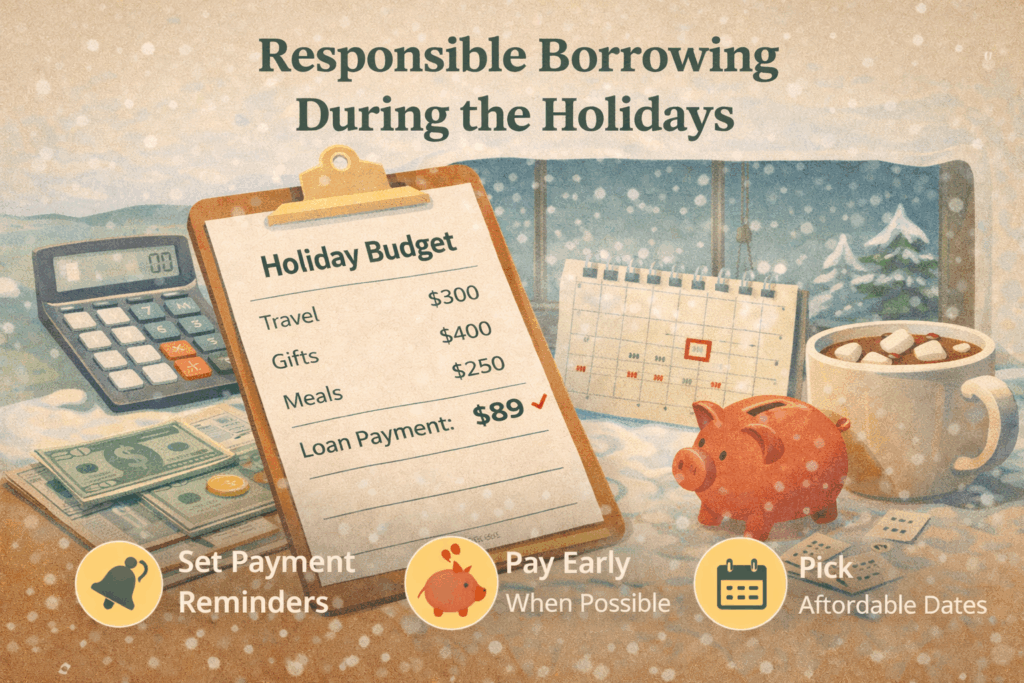

Responsible borrowing during the holidays

A simple plan helps you use the loan wisely and avoid headaches in January.

-

Set a single budget number for the season

Include travel, gifts, food, and any planned events. -

Track purchases in one place

A spreadsheet or notes app works. Consistency matters more than the tool. -

Pick an affordable payment window

Align the due date with your paycheck cycle. -

Automate your first payment

Set autopay on day one to protect your on time record. -

Pay early when possible

With no prepayment penalties, even small extra payments can cut interest.

Alternatives to consider

A balanced decision looks at more than one path.

-

Talk to your utility or service provider about a payment plan

-

Use employer earned wage access if offered

-

Sell unused items or pause nonessential subscriptions

-

Borrow a smaller amount than you first planned to reduce cost

If these options do not meet your timeline, a well structured cash loan with a clear payoff plan can still be a practical solution.

Common questions about cash loans in Utah

Will applying hurt my credit?

Money 4 You does not run a hard credit check, so applying will not involve a hard pull.

How fast is funding?

After approval, funds can be transferred within seconds.

Can I pay off early?

Yes. There are no prepayment penalties, so paying early reduces interest.

What if I am new to credit?

Complete documentation and a right sized request can still support approval. Focus on affordability and accuracy.

Do I need collateral?

These are unsecured installment loans, so no collateral is required.

The bottom line

Holiday pressure does not have to turn into long term stress. With preparation and a clear plan, cash loans in Utah can provide fast funding and predictable payments. Money 4 You keeps the process simple with no hard credit check, approvals that can take less than 10 minutes, funds in seconds after approval, and no prepayment penalties. Start by confirming your budget, gathering your documents, and choosing a term that fits your life as you head into the new year.

Apply Now or Call Us at (855) MY-MRMONEY

Quick Loan Application

Get started on your Short Term Installment Loan Application from Money 4 You Loans